For decades, proving that a generic drug works the same as the brand-name version meant testing it in people. Hundreds of volunteers, blood draws every hour, weeks of monitoring - all to confirm the drug gets into the bloodstream the right way. It’s expensive, slow, and ethically tricky. But now, a smarter method is taking over: IVIVC. This isn’t science fiction. It’s a validated, regulatory-approved way to replace human trials with lab tests - if you do it right.

What IVIVC Actually Means (And Why It Matters)

IVIVC stands for In Vitro-In Vivo Correlation. In plain terms, it’s a mathematical link between what happens to a drug in a test tube and what happens inside the human body. If you can show that how fast a pill dissolves in a lab machine reliably predicts how fast it gets absorbed in the blood, you don’t need to test it in people. That’s the biowaiver - a regulatory green light to skip the human study.

The U.S. FDA first laid out the rules in 1996. Since then, the framework has gotten tighter. Today, IVIVC isn’t optional for complex drugs like extended-release pills or patches. It’s the only practical path to market. Without it, every tiny change in the formula - even switching a filler ingredient - requires a new clinical trial. With it, you can make those changes and submit a dissolution profile instead. That saves months and up to $2 million per study.

The Four Levels of IVIVC: Not All Correlations Are Equal

Not every lab result counts. The FDA classifies IVIVC into four levels, and only one really gets you the waiver: Level A.

- Level A: This is the gold standard. It matches dissolution at every single time point to blood concentration at the same point. Think of it like a perfect mirror. If your pill dissolves 40% at 1 hour in the lab, the body absorbs 40% at 1 hour in the patient. The model needs an R² value above 0.95 and a slope near 1.0. Only this level allows full biowaivers for post-approval changes.

- Level B: Uses averages - mean dissolution time vs. mean residence time. It’s useful for screening, but can’t predict individual patient responses. Not accepted for waivers.

- Level C: Links one dissolution point (like 70% dissolved at 2 hours) to one PK parameter (like Cmax). Limited. Sometimes accepted if you stack multiple Level C points, but regulators are skeptical.

- Multiple Level C: Several single-point correlations. Easier to build, but risky. The EMA and FDA warn these often miss real-world variability, especially with food effects or gut differences.

For extended-release products - think 12-hour pain pills - Level A is the only way to get a full waiver. For immediate-release drugs, the BCS system (Biopharmaceutics Classification System) is simpler. But for anything that slows down absorption, IVIVC is non-negotiable.

Why Most IVIVC Submissions Fail

Here’s the hard truth: only about 42% of IVIVC submissions get approved today - up from 15% in 2018, but still a high failure rate. Why?

The biggest reason? Lab conditions don’t match the gut. Traditional dissolution tests use plain water or buffer at pH 6.8. But the human stomach isn’t that simple. Bile salts, enzymes, food, pH shifts - they all change how a drug dissolves. A pill that looks perfect in a test tube might dissolve too slowly or too fast in a real person.

That’s why biorelevant media is now essential. Instead of water, labs use solutions that mimic stomach and intestinal fluid - with bile salts, phospholipids, and controlled pH gradients. The University of Maryland showed this can boost correlation accuracy by up to 70%. Yet, 82% of failed submissions still used outdated methods.

Another common failure? Not testing enough formulations. You need at least three versions of the drug - fast, medium, and slow dissolving - to build a reliable model. Most companies try to cut corners with just one or two. The FDA sees through it. One Teva executive said it took them 14 months and three formulation tries before their oxycodone IVIVC was accepted. They avoided five full bioequivalence studies. That’s the payoff.

Who Can Do This? Not Everyone

IVIVC isn’t something you hand to a junior scientist and expect results. It requires a team: formulation experts, pharmacokinetic modellers, analytical chemists, and regulatory strategists. You need access to high-end dissolution equipment, pharmacokinetic sampling labs, and the ability to run multiple clinical studies with dense blood sampling - 12+ time points per subject.

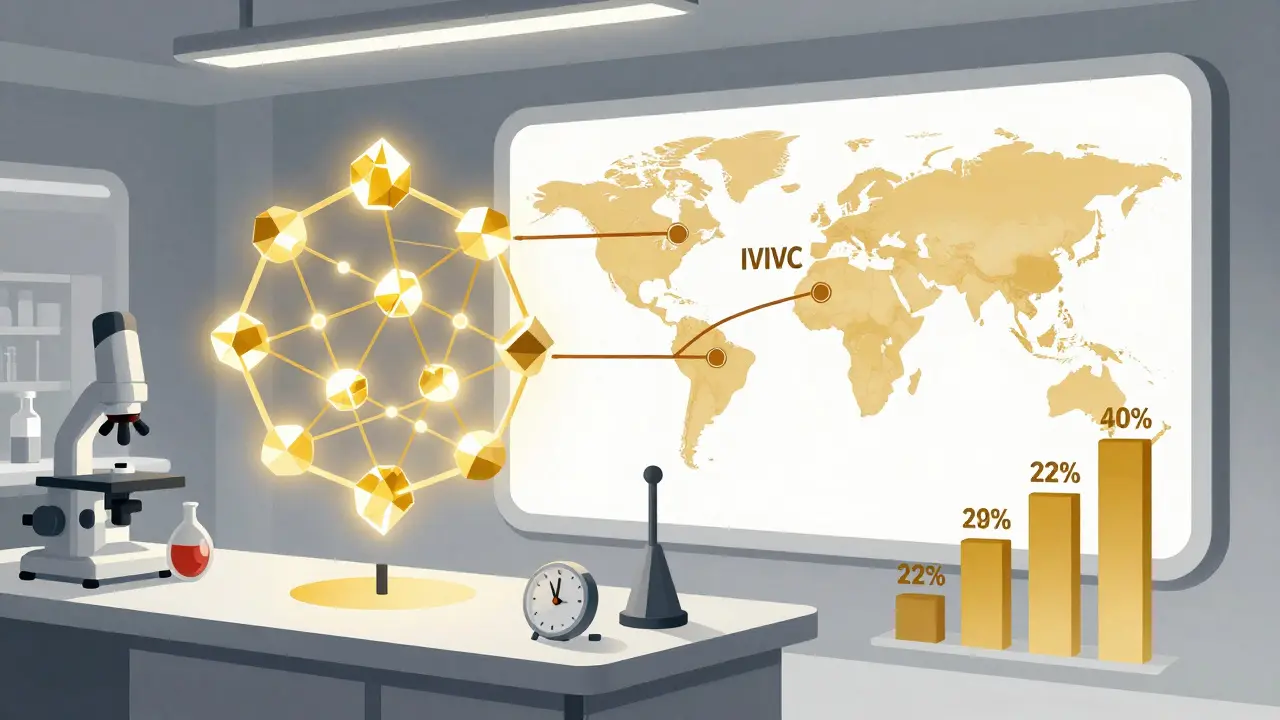

Only about 15% of pharma companies have this expertise in-house. Most turn to contract research organizations like Alturas Analytics or Pion. Their success rate? 60-70%. Industry average? 30-40%. The difference? Early involvement. Companies that bring in IVIVC experts during Phase 2 of development (or during prototype testing for generics) have a much better shot.

Training matters too. The American Association of Pharmaceutical Scientists (AAPS) has offered certification since 2015. You need a master’s or PhD in pharmaceutics and at least two years of hands-on work. This isn’t a shortcut. It’s a specialized skill.

Where IVIVC Works - And Where It Doesn’t

IVIVC isn’t magic. It has limits.

Works well:

- Extended-release oral tablets and capsules

- Modified-release patches

- Complex generics where BCS doesn’t apply (Class II, III, IV drugs)

- Post-approval changes: manufacturing site, scale-up, minor excipient changes (as long as f2 similarity >50)

Doesn’t work:

- Narrow therapeutic index drugs (like warfarin, digoxin, lithium)

- Drugs with nonlinear absorption or metabolism

- Injectables and ophthalmic products (though EMA is exploring it)

- Products affected strongly by food or gut pH

The FDA’s 2023 review of 127 submissions found 64% failed because dissolution conditions weren’t physiologically relevant. Another 28% failed because the model wasn’t validated properly - no testing with different food states, no sensitivity analysis, no cross-validation with real patient data.

The Future: Machine Learning and Global Harmonization

IVIVC is evolving. The FDA and EMA held a joint workshop in 2024 on machine learning models for IVIVC. Instead of linear regression, AI can now spot patterns in dissolution and PK data that humans miss. Early results are promising - but regulators demand full transparency. You can’t use a black box. Every variable must be explainable.

Also, the scope is expanding. In June 2023, the FDA released draft guidance for IVIVC in topical products - creams, gels, ointments. That’s huge. If it works for skin absorption, it could revolutionize dermatology generics.

By 2027, McKinsey predicts IVIVC-supported waivers will cover 35-40% of all modified-release generic approvals - up from 22% in 2022. The global dissolution testing market hit $487 million in 2022 and is growing at 6.2% yearly. That’s not just equipment sales. It’s demand for smarter, more accurate science.

Real-World Impact: Cost, Time, and Access

Let’s put numbers to it.

A full bioequivalence study costs $500,000 to $2 million. It takes 6-12 months. IVIVC development? $1-2 million upfront - but it covers all future changes for that product. One successful IVIVC can save a company $10 million over five years in avoided studies.

But the bigger win? Faster access to medicines. When a generic maker can skip human trials, they can bring affordable versions to market faster. For chronic disease drugs - diabetes, hypertension, pain - that’s life-changing. IVIVC isn’t just a cost-cutting tool. It’s a public health accelerator.

Still, the gap remains. Only five of the top ten generic companies have dedicated IVIVC teams: Teva, Mylan, Sandoz, Sun Pharma, and Lupin. Smaller players still struggle. The FDA’s GDUFA III funding ($15 million for IVIVC research through 2027) is meant to close that gap. More guidance, more training, more tools.

Bottom Line: It’s Not Easy, But It’s Necessary

IVIVC is not a quick fix. It’s not something you can outsource to a cheap lab. It requires deep science, careful planning, and regulatory savvy. But for any company making complex generics, it’s no longer optional. The days of relying on human trials for every little change are ending.

If you’re developing an extended-release drug, your path to market runs through dissolution testing - not blood samples. The science is there. The regulators are ready. The only question is: are you prepared to do it right?

Ryan Pagan

Man, I’ve seen so many generic companies waste six figures on bioequivalence studies when they could’ve just nailed the IVIVC. The key? Biorelevant media. No more plain buffer solutions. You gotta mimic bile salts and gastric pH or you’re just guessing. I worked with a team that switched from water to FaSSIF and saw their correlation jump from 0.6 to 0.98. FDA approved it on the first try. It’s not magic-it’s just doing the work right.

And don’t even get me started on those ‘Level C’ shortcuts. One point doesn’t cut it. You need the full curve. The FDA’s not dumb. They’ve seen it all.

Pro tip: Bring in the IVIVC experts during Phase 2. Not after you’ve blown your budget on failed human trials. That’s like hiring a pilot after your plane’s already crashed.